Risk Management Policy and Procedure

The company's risk management policy is established in accordance with its operational guidelines to identify various types of risks, prevent potential losses within the acceptable risk level, and enhance risk management to achieve the company's goal of sustainable operations. The Board of Directors approved the "Risk Management Policy and Regulations" on August 5, 2022.

Risk Management Category

The Company conducts regular risk assessments in accordance with the "Risk Management Policy and Regulation." To continuously enhance the risk management mechanism, the Company evaluates the likelihood and impact of various risks arising from daily business activities and adopts appropriate countermeasures to continuously improve and reduce corporate risks. The operational risks faced by the Company include, but are not limited to, financial risks, technology and product risks, purchase risks, climate change risks, information security risks, human resource risks, and other business-related risks. To ensure that all risks remain within an acceptable tolerance level, the Company may establish consolidated risk categories and management indicators, which are monitored periodically by each business unit.

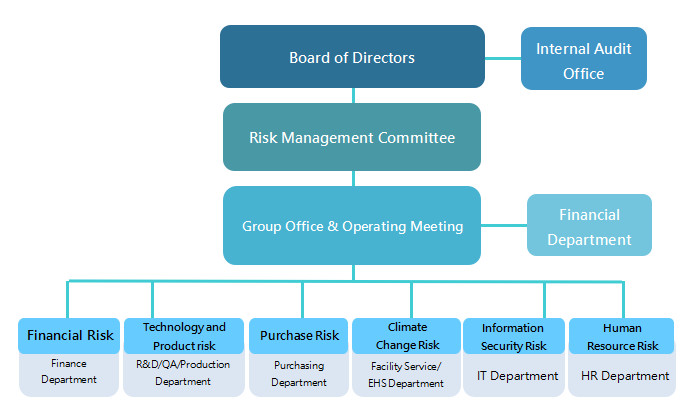

Risk Management Organization

On November 8, 2024, the Company established the Risk Management Committee under the Board of Directors. The Committee is composed of four independent directors. For details regarding the members and operations of the Risk Management Committee, please refer to the Risk Management Committee section under Corporate Management in the Investor Relations area.

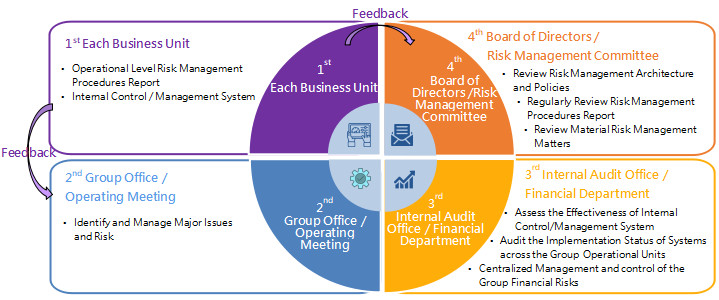

Risk Management Structure and Responsibilities

1.Board of Directors:The Board of Directors is the highest authority of company's risk management.

2.Risk Management Committee:This committee assists the Board in fulfilling its risk management responsibilities and supervises the operation of the company's risk management.

3.Operating Meeting:The executive or operational meeting, chaired by the Group Chairman or the Group General Manager, is responsible for managing and reviewing the company's risk management implementation, risk assessment, and risk-taking activities.

4.Finance Department:The Finance Department, under the Office of the International Group Office, is independent of all business departments and is responsible for managing fund allocation and conducting investment evaluations.

5.Internal Audit Office:The Internal Audit Office is an independent unit affiliated with the Board of Directors, responsible for internal control and internal auditing. It conducts audits of each department's risk management practices in accordance with applicable laws and regulations.

6.Each Business Unit:Business Unit managers bear the primary responsibility for frontline risk management. They are responsible for analyzing and monitoring relevant risks to ensure that the risk control mechanisms and procedures can be effectively implemented.

Framework of Risk Governance and Management Architecture

Risk Management Procedures

Risk Assessment and Response Measures

The company conducts relevant risk assessments based on the principle of materiality, and based on the assessed risks, formulates relevant risk management responses measures as follows:

|

Risk Category |

Potential Risk |

Response Measures |

|

Financial Risk |

Interest Rate

Fluctuations |

Regular evaluation of market capital status and bank interest rates to assess the impact of interest expenses of financing. |

|

Exchange Rate

Fluctuations |

1. Natural off-setting principles are adopted in terms of currency risks. Forward foreign exchange contracts and borrowing foreign currency debt may be adopted as necessary and appropriate.

2. Keeping in close contact with the bank and monitoring changes of the foreign currency market at all times in order to provide related supervisors with exchange rate change trends. Adjustments can be made immediately if there is an occasional change in the currency of receipt or payment. |

|

Inflation |

Flexible adjustment of procurement and sales strategies, cost structures and transaction conditions to effectively respond to the impact of inflation or deflation. |

|

Technology and

Product Risk |

Product Development Risks |

Conduct new product development risk assessment and R&D progress control. |

|

Quality Abnormality |

In accordance with the ISO 9001 international quality management system standard, we have established a quality management system and formulated a quality manual to serve as a framework for the implementation of quality management and as a basis for the practice of quality management in all departments. |

|

Purchase Risk |

Supply Interruption |

1. Regularly review the safety stock quantity of all raw materials and make a timely request of reasonable quantities

2. Proactively develop qualified suppliers to increase supply sources. |

|

Climate Change

Risk |

Climate Disaster |

Implement energy conservation by setting up related facilities, such as lightning rods, water pumps, ventilators, municipal water storage equipment, special air conditioning equipment in the machine room, standby generators and waterproof gates, and more |

|

Information

Security Risk |

Abnormal Information

System |

1. Information security-related regulations have been established to strengthen the prevention of disasters, information security, monitoring, notification mechanism, and the handling of abnormalities.

2. In terms of the management and backup important systems, an off-site back-up system has been established and a dedicated unit has been set up to oversee related matters. |

|

Human Resource

Risk |

Operational disruptions due to manpower shortage |

Enhancement of talent nurturing and retention programs, in order to avoid manpower shortage. |

Operation of Risk Management

The company has established "Risk Management Policy and Regulations", and will report its operation to the Board of Directors at least once a year since 2022. The reporting dates to the Board of Directors for 2025 is November 13.