Employee Compensation and Performance

AirTAC has established a comprehensive system for employee promotion and compensation, such as the M/T Grade Standard Guidelines, offering pay levels that exceed local minimum wage requirements and are above the industry average. Compensation for new employees is determined based on job requirements, educational background, and relevant experience. After onboarding, salary adjustments and promotions are granted annually according to individual performance.

A well-defined performance evaluation system has been implemented, with promotion criteria established based on individual capabilities and years of service. These are complemented by generous welfare programs designed to further encourage employee potential. Job promotions are carried out in accordance with performance evaluation results.

At AirTAC Taiwan, all employees undergo performance evaluations semiannually, while at AirTAC Ningbo, AirTAC China, and AirTAC Guangdong, evaluations are conducted quarterly. For employees who retire or whose employment is terminated, AirTAC provides severance pay that exceeds statutory requirements to assist them during the transition period.

Compensation Policy and Actual Salary Adjustments for Rank-and-File Employees

The Company incorporates operating performance into the design of its employee compensation and incentive system, and comprehensively considers employees' years of service and annual performance evaluation results as the basis for salary adjustments for rank-and-file employees. In 2025, the average salary increase for rank-and-file employees is around 6%.

Employee Welfare

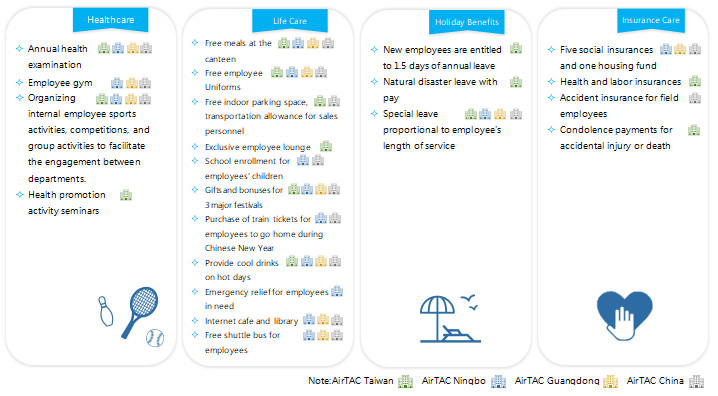

AirTAC regards employees as one of the most important factors for sustainable corporate development, and provides comprehensive and diverse employee benefits across four key areas: health, lifestyle, leave, and insurance. These include employee recreation areas, dedicated staff to organize leisure activities, and occasional events or trips to relieve work-related stress and create a friendly and supportive workplace environment.

Pension System and State of Implementation

All subsidiaries of the Company located within the Republic of China (Taiwan) have established employee retirement plans in accordance with the "Labor Standards Act." In compliance with the new Labor Pension Act, the Company contributes 6% of employees' monthly wages to their individual labor pension accounts. In 2024, the Company recognized NT$37,141 thousand in contributions to the new pension scheme for its Taiwan operations.

For employees of entities located in mainland China, the Company makes monthly contributions to local government social insurance accounts in accordance with the Social Insurance Law of the People's Republic of China to fund post-retirement pension benefits. For other overseas locations, retirement benefits are provided in accordance with the relevant local laws and regulations. In 2024, the Group recognized a total post-retirement benefit expense of NT$364 million.